Stainless Steel Price Volatility: Hedging Strategies for B2B Buyers to Lock in Duplex & Alloy Costs

When nickel sneezes, stainless steel catches a cold—and duplex alloys land in the ICU.

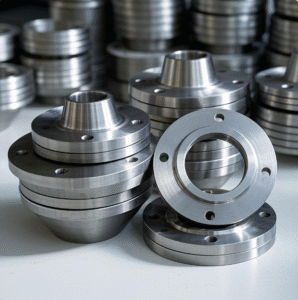

For B2B buyers procuring duplex stainless steel (e.g., UNS S32205, S32750) and specialty alloys, price volatility isn’t an accounting nuisance—it’s an existential threat. A 20% nickel surge can inflate duplex costs by $1,500/ton overnight. Molybdenum (Mo) price swings compound this: a $5/lb Mo spike adds ~$220/ton to S32750. Passive purchasing erodes margins and derails project bids.

Here’s how leading industrial buyers hedge strategically:

1. Decoding the Cost Drivers: Where Volatility Lives

Stainless pricing = Base alloy cost + alloy surcharge + processing premiums.

-

Base Price: Negotiated quarterly/long-term (relatively stable).

-

Alloy Surcharge: Resets monthly (or weekly!). Driven by:

-

LME Nickel (50–60% of duplex cost)

-

Molybdenum Oxide (10–25% for grades like 2507)

-

Ferrochrome, Copper, Scrap

-

-

Processing Premiums: Mill-specific (e.g., ArcelorMittal’s “X” factor for quench rates in super duplex).

Example: Duplex 2205 (S32205) surged 32% in Q1 2024 after Indonesia restricted nickel ore exports—despite flat base prices.

2. Hedging Instruments: Beyond Basic Futures

a) LME Nickel Futures (Weak for Alloys)

-

Problem: LME’s Class I nickel (99.8% pure) doesn’t reflect stainless scrap (Class II) or ferro-nickel prices. Basis risk exceeds 15%.

-

Fix: Pair LME positions with Ferro-Nickel OTC Swaps (traded via Sucden, Marex).

b) Molybdenum Lock-ins

-

Direct: Buy Mo oxide futures (CME, LME) if volumes align.

-

Indirect: Negotiate fixed Mo surcharges with mills. Example: Outokumpu’s 6-month “Mo Cap” for 2507 buyers.

c) Alloy-Specific Surcharge Hedging

-

Mill Surcharge Agreements: Sign fixed-surcharge contracts (e.g., “Nickel @ $18,000/t; Mo @ $25/lb for 12 months”).

-

Index-Linked Pricing: Tie pricing to CRU Stainless Steel Monitor or MEPS Alloy Surcharge Index + fixed premium.

3. Duplex-Specific Tactics: Precision Hedging

a) Component-Level Cost Control

-

Nickel: Hedge 50–60% of forecasted duplex usage via OTC swaps.

-

Molybdenum: Over-hedge Mo by 10% (volatility buffer).

-

Nitrogen: Monitor ammonia prices (key for duplex melt shops).

b) Contract Structures That Shift Risk

-

Pass-Through Agreements: For long projects, bind suppliers to actual monthly surcharges + fixed processing fee.

-

Caps/Collars: Pay a premium to set:

-

Cap: Maximum payable surcharge (e.g., Ni ≤ $22,000/t).

-

Collar: Range (e.g., Ni: $16,000–$21,000/t).

-

c) Physical Stock Strategies

-

Strategic Buffers: Hold 2–3 months of duplex stock when:

-

Nickel backwardation > 5% (spot > futures)

-

Mo inventories at 5-year lows (per CRU)

-

-

Consignment Hubs: Partner with service centers for JIT delivery from bonded warehouses.

4. Real-World Hedging Playbook: Case Study

Client: European pressure vessel fabricator (annual duplex use: 1,200 tons).

Threat: Bid for $50M offshore project requiring price certainty over 18 months.

Strategy:

-

Locked base price with mill (Sandvik) for 18 months.

-

Capped surcharges: Ni ≤ $20,000/t, Mo ≤ $30/lb via OTC options (cost: 4% of notional).

-

Bought LME nickel puts for 50% of volume as backup.

-

Pre-purchased 300 tons of 2507 plate during a dip in ferro-nickel prices.

Result: Avoided $620,000 in cost overruns when nickel spiked 28% post-contract signing.

5. When Not to Hedge: Risk Mitigation Rules

-

Avoid hedging during contango (futures > spot)—stock buildup is cheaper.

-

Never hedge > 80% of forecasted usage—over-hedging creates loss when prices fall.

-

Verify supplier formulas: Some mills manipulate surcharge weights (e.g., overstating Ni content in duplex). Audit via third parties like SMR GmbH.

Conclusion: Treat Alloys Like Commodities—Because They Are

B2B buyers must pivot from price-taking to price-making:

-

Monitor: Track LME nickel, CME molybdenum, and scrap spreads daily.

-

Hedge: Use layered instruments (futures + OTC + physical).

-

Negotiate: Demand transparent surcharge formulas and caps.